louisiana estate tax rate

Follow the steps to view the Maximum Millage Report PDF for the selected parish and year. Louisiana also does not have an inheritance or gift tax.

Four Dead 20 000 Rescued From Louisiana Flooding Louisiana Flooding Louisiana Flood

Tax rates are expressed in mills with a mill equal to 1 of tax for every 1000 of assessed value.

. Your 2022 tax rate will be. Such estates or trusts may elect to be taxed at the rate of five percent on total gross income from Louisiana sources. Compared to the nationwide 107 average effective property tax rate Louisiana has a generous rate at 053.

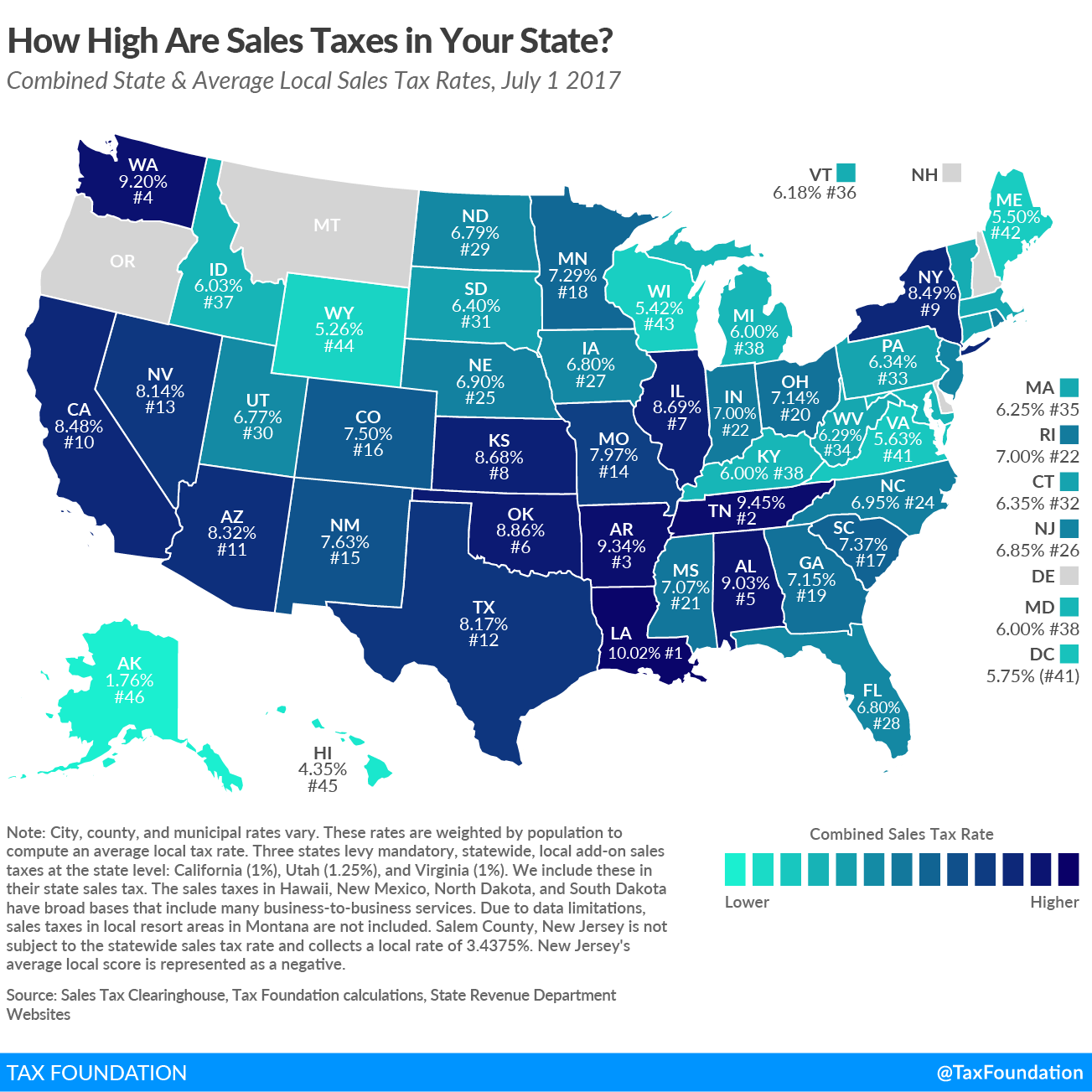

However because of the varying tax rates between taxing districts the average tax bill fluctuates from parish to parish. Louisiana has a 445 percent state sales tax rate a max local sales tax rate of 700 percent and an average combined state and local sales tax rate of 955 percent. Tax rate of 35 on taxable income between 12501 and 50000.

We dont make judgments or prescribe specific policies. Tax rate of 185 on the first 25000 of taxable income. Louisiana also has a corporate income tax that ranges from 350 percent to 750 percent.

It really should not be much of a surprise. Detailed Louisiana state income tax rates and brackets are available on this page. Whether you are already a resident or just considering moving to Louisiana to live or invest in real estate estimate local property tax rates and learn how real estate tax works.

You can look up your recent appraisal by filling out the form below. 50000 60. Average Property Tax Rate in Louisiana.

Notification of Change of Sales Tax Rate for Remote Dealers and Consumer Use Tax. See what makes us different. The Max Mill Reports currently on our website are not the same reports that were generated in a specific year.

Louisiana has some of the lowest property tax rates in the US as only Alabama and Hawaii residents pay less on average than residents of the Pelican State. Gift tax inheritance tax. If your home has an assessed value of 15000 and the taxing district where the property is located has a millage rate of 50 your Louisiana property tax bill will add up to 750.

The Economic Growth and Tax Relief Reconciliation Act of 2001 phased out the state estate tax credit between 2002 and 2005 and replaced the credit with a deduction for state estate taxes for deaths that occur. Ad Non-partisan not-for-profit resource for US data statistics on a variety of topics. If you are planning to buy a home in Louisiana and want to understand how much your property tax bill.

There is no estate tax in Louisiana but residents of the Bayou State may still have to pay the federal estate tax if their estate is worth enough. 6 on more than 50000 of taxable income. Decrease in State Sales Tax Rate on Telecommunications Services and Prepaid Calling Cards Effective July 1 2018.

2 on 12500 or less of taxable income for individuals 25000 for joint filers High. Table of Sales Tax Rates for Exemption for the period July 2013 June 30. Regenerated Max Mill Reports from 2005-2009 for all parishes except.

They have been regenerated using current database information. Louisiana Department of Revenue. Louisiana has one of the lowest median property tax rates in the United States with only states collecting a lower median property tax than Louisiana.

The Louisiana state sales tax rate is 4 and the average LA sales tax after local surtaxes is 891. 100000 for joint filers Starting in 2022 Louisianas. Parishes equivalent to counties and cities in Louisiana are allowed to charge an additional local sales tax on top of the Iowa state sales tax.

For married taxpayers living and working in the state of Louisiana. Revenue Information Bulletin 18-019. The median property tax in Louisiana is 24300 per year based on a median home value of 13540000 and a median effective property tax rate of 018.

The median property tax in Louisiana is 24300 per year018 of a propertys assesed fair market value as property tax per year. Your 2021 tax rate is. The Louisiana income tax has three tax brackets with a maximum marginal income tax of 600 as of 2022.

Tax rate of 425 on taxable income over 50000. Louisianas median income is 54216 per year so the median yearly. Because it is so high make sure to reduce your net assets as low as possible to minimize any estate tax liability.

Learn all about Louisiana real estate tax. Revenue Information Bulletin 18-017. Louisiana Property Taxes Range.

Tax amount varies by county. Most states with no estate tax have no gift tax either. On average a homeowner pays 505 for every 1000 in home value in property taxes with the average Louisiana property tax bill adding up to 832.

Louisiana has a graduated individual income tax with rates ranging from 185 percent to 425 percent. The estate tax rate at the federal level is 40. Based on latest data from the US Census Bureau.

The portion of the state death tax credit allowable to Louisiana that exceeds the inheritance tax due is the state estate transfer tax. Returns and payments are due on May 15th of each year on the preceding years income or on the 15th day of the fifth month after the close of the taxpayers fiscal period. December 18 2018 205 PM.

Tax rate of 185 on the first 12500 of taxable income.

Historical Louisiana Tax Policy Information Ballotpedia

Louisiana Retirement Tax Friendliness Smartasset

115 Fitzwilliam Street Louisiana Homes House Styles Tuscany Villa

Louisiana Estate Tax Everything You Need To Know Smartasset

Louisiana Estate Tax Everything You Need To Know Smartasset

Louisiana Income Tax Calculator Smartasset

Louisiana Sales Tax Small Business Guide Truic

Louisiana S Tax Reform Breakthrough Wsj

Are There Any States With No Property Tax In 2020 Free Investor Guide Property Tax Small Towns Usa West Virginia

122 Poverty Pointe Open Concept Home Louisiana Homes New Homes

Louisiana S Tax Reform Breakthrough Wsj

Louisiana La Tax Rate H R Block

Louisiana Estate Tax Everything You Need To Know Smartasset

America S 15 States With Lowest Property Tax Rates

5 Refreshing Ways To Spend Your Tax Refund

State Corporate Income Tax Rates And Brackets Tax Foundation

Louisiana Sales Tax Rate Remains Highest In The U S Legislature Theadvocate Com

State By State Guide To Taxes On Retirees Social Security Benefits Retirement Retirement Strategies Retirement